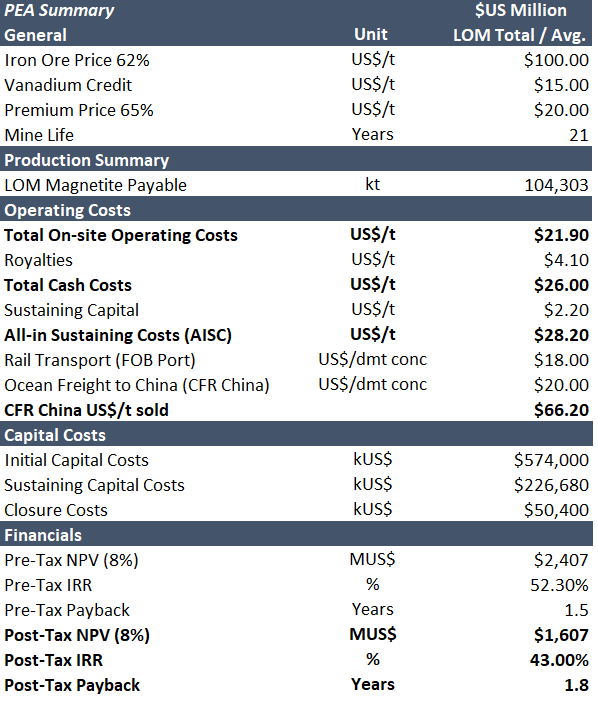

PEA Results July 2022

Highlights

- Annual average EBITDA of US$348MM and average annual free cash flow of US$235MM over 21 year life of mine (“LOM”)

- Annual production targeted at approx. 5.0 million tonnes of high grade, low impurity, iron concentrate grading ~65% iron with 0.52% V2O5 per tonne of concentrate

- Total operating costs of US$66/t of concentrate over LOM (freight to China included)

- Initial Capex estimated at US$574 million includes US$118 million contingency

- Payback period under 2 years

- 21-year LOM uses fraction of total resources

- Open pit mining operation with a LOM strip ratio less than 0.9:1

- Additional upside from the potential to expand development from the current North Zone Inferred Resources (507Mt) and South Zone Indicated (119Mt) and Inferred (89Mt) Resources

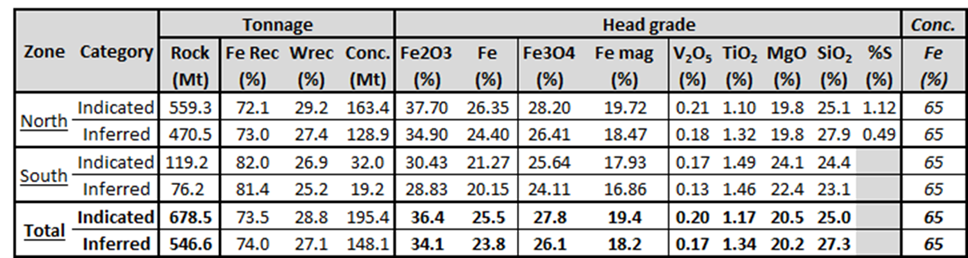

Mineral Resource Estimate

The PEA is based on a mine plan derived from the North Zone Indicated Material of the Mineral Resource Estimate dated June 6, 2022, outlined below.

Mineral Resource Estimate used in Preliminary Economic Analysis

Notes to accompany the Mineral Resource Estimate:

- The independent and qualified persons for the Mineral Resource Estimate, as defined by NI 43-101, are Marina Iund, P.Geo., Carl Pelletier, P.Geo., Simon Boudreau, P.Eng. all from InnovExplo Inc. and Mathieu Girard P.Eng. from Soutex. The effective date is June 6th, 2022

- These mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The Mineral Resource Estimate follows current CIM Definition Standards.

- The results are presented undiluted and are considered to have reasonable prospects for eventual economic extraction by having constraining volumes applied to any blocks using Whittle software and by the application of cut-off grades for potential open-pit extraction method.

- The estimate encompasses two (2) deposits (North and South), subdivided into 8 individual zones (7 for North, 1 for South).

- No high-grade capping was applied.

- The estimate was completed using sub-block models in GEOVIA Surpac 2021.

- Grade interpolation was performed with the ID2 method on 4 m composites for the North deposit and on 10 m composites for the South deposit.

- The density of the mineralized zones was interpolated with the ID2 method. When no density analysis was available, the density value was estimated using linear regression with Fe2O3 analysis. For the unmineralized material, a density value of 2.8 g/cm3 (anorthosite and volcanics), 3.5 g/cm3 (Massive sulfide formation) and 2.00 g/cm3 (overburden) was assign.

- The Mineral Resource Estimate is classified as Indicated and Inferred. The Inferred category is defined with a minimum of two (2) drill holes for areas where the drill spacing is less than 400 m, and reasonable geological and grade continuity have been shown. The Indicated category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 200 m, and reasonable geological and grade continuity have been shown. Clipping boundaries were used for classification based on those criteria.

- The Mineral Resource Estimate is locally pit-constrained for potential open-pit extraction method with a bedrock slope angle of 50° and an overburden slope angle of 30°. It is reported at a rounded cut-off grade of 2.30 % Weight Recovery. The cut-off grade was calculated for the concentrate using the following parameters: royalty = 3%; mining cost = CA$3.30; mining overburden cost = CA$2.45; processing cost = CA$3.62; G&A = CA$0.75; selling costs = CA$58.36; Fe price = CA$190/t; USD:CAD exchange rate = 1.3; and mill recovery = 100% (concentrate). The cut-off grades should be re-evaluated considering future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects.

- The authors are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues, or any other relevant issue not reported in the Technical Report, that could materially affect the Mineral Resource Estimate.

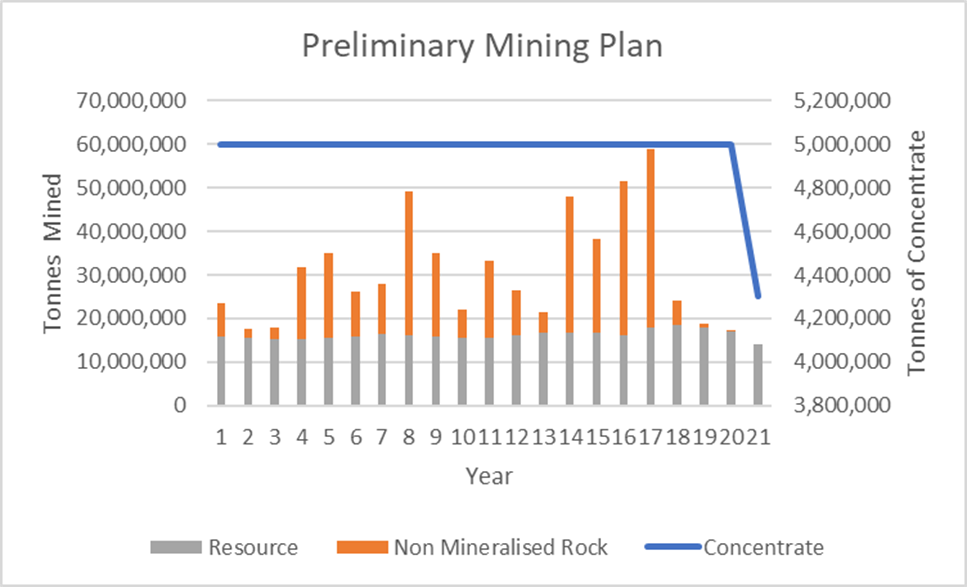

Mining

The mine design is based only upon the current Indicated Resources contained in the North Zone alone and assumes standard open pit mining techniques of drill, blast and haul. Voyager developed a mine plan which processes 341.5 million tonnes of the current Indicated Resource base over a 21-year mine life at an average strip ratio of 0.87 to 1. Mining costs are estimated at US$2.03/t of material moved.

Figure 2. Mont Sorcier Preliminary Mine Production Profile

Metallurgy and Processing

The results of the test work to date have indicated that the production of premium high grade 65% magnetite iron concentrate with approximately 0.52% V2O5 can be achieved.

The processing plant designed for Mont Sorcier is forecast to be in line with similar projects in production locally and globally using standard equipment and technologies. The study envisages a conventional crushing and grinding circuit, with three stages of low intensity magnetic separation (LIMS). In addition to the flow sheet previously contemplated, this PEA includes a reverse flotation circuit. The reverse flotation circuit has been included so that the concentrate will have a sulphur content of approximately 0.1% which allows for sale in both Europe and China. The initial testing results support and indicate the viability of Sulphur removal performance.

Infrastructure

The site is located with access to all weather roads, water, low-cost grid hydro power and sufficient railway capacity to support project development with only modest infrastructure capital needs. The PEA incorporates expenditures required for additional infrastructure including auxiliary buildings, electrical grid connection, rail loading facilities at the mine site and unloading facilities at the Port of Saguenay. This also includes a new rail loop at the mine to improve loading efficiencies and a new rail spur to connect to the main line to the Port of Saguenay. For the PEA it has been assumed all concentrate production will be rail hauled to the Port of Saguenay for international shipment to China or Europe. Given the proximity to Chibougamau, no permanent camp is required for the anticipated permanent workforce.

In addition, the project will also include new tailing facilities in a location to the North of the open pit. The location of a Non-Mineralized Rock waste dump will be determined after consultation with local stakeholders and additional engineering and design.

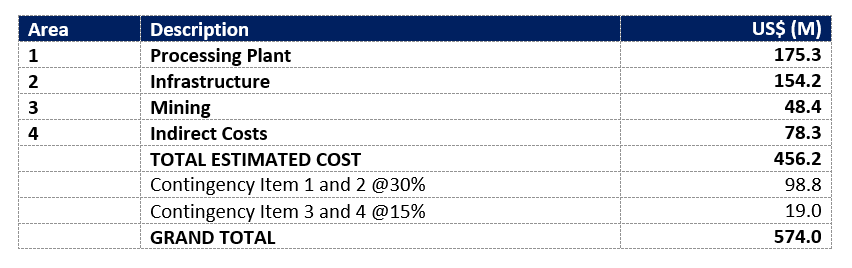

Capital Costs

Upfront capital costs are estimated at US$574M, deemed in accordance with the requirements of the Association for the Advancement of Cost Engineering (AACE) International Cost Estimate Classification System Recommended Practice No. 18R-97 Class 5, with an estimated pay back of under 2-years with an estimated after-tax IRR of 43%. Upfront capital costs have been factored to allow for current inflationary pressures, anticipated changes in equipment sizing, an increase in rail spur length, estimated costs for enabling of construction of accommodation, and the addition of the reverse flotation circuit to the process plant.

The PEA capital cost estimates include a 15% contingency for mining equipment and Indirect costs and 30% for plant and infrastructure.

Upfront Capital Cost Estimate used in Preliminary Economic Analysis

Sustaining capital is estimated at approximately US$2.2/t over the LOM and is principally related to equipment replacement and future tailings dam raises during operation.

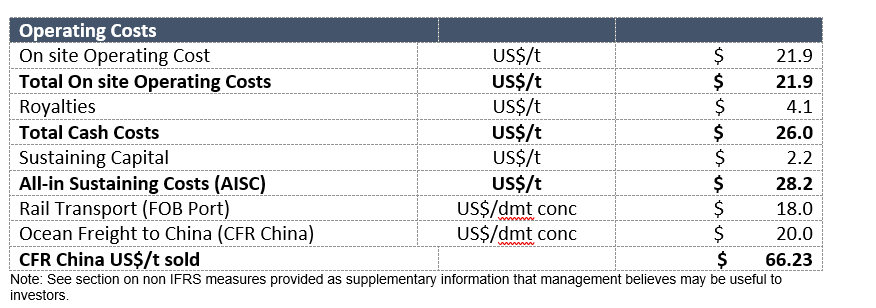

Operating Costs

The LOM operating costs are estimated at US$66.23/t CFR China. This value has been benchmarked against actual costs of Operators in the area.

Operating Cost Estimate used in Preliminary Economic Analysis

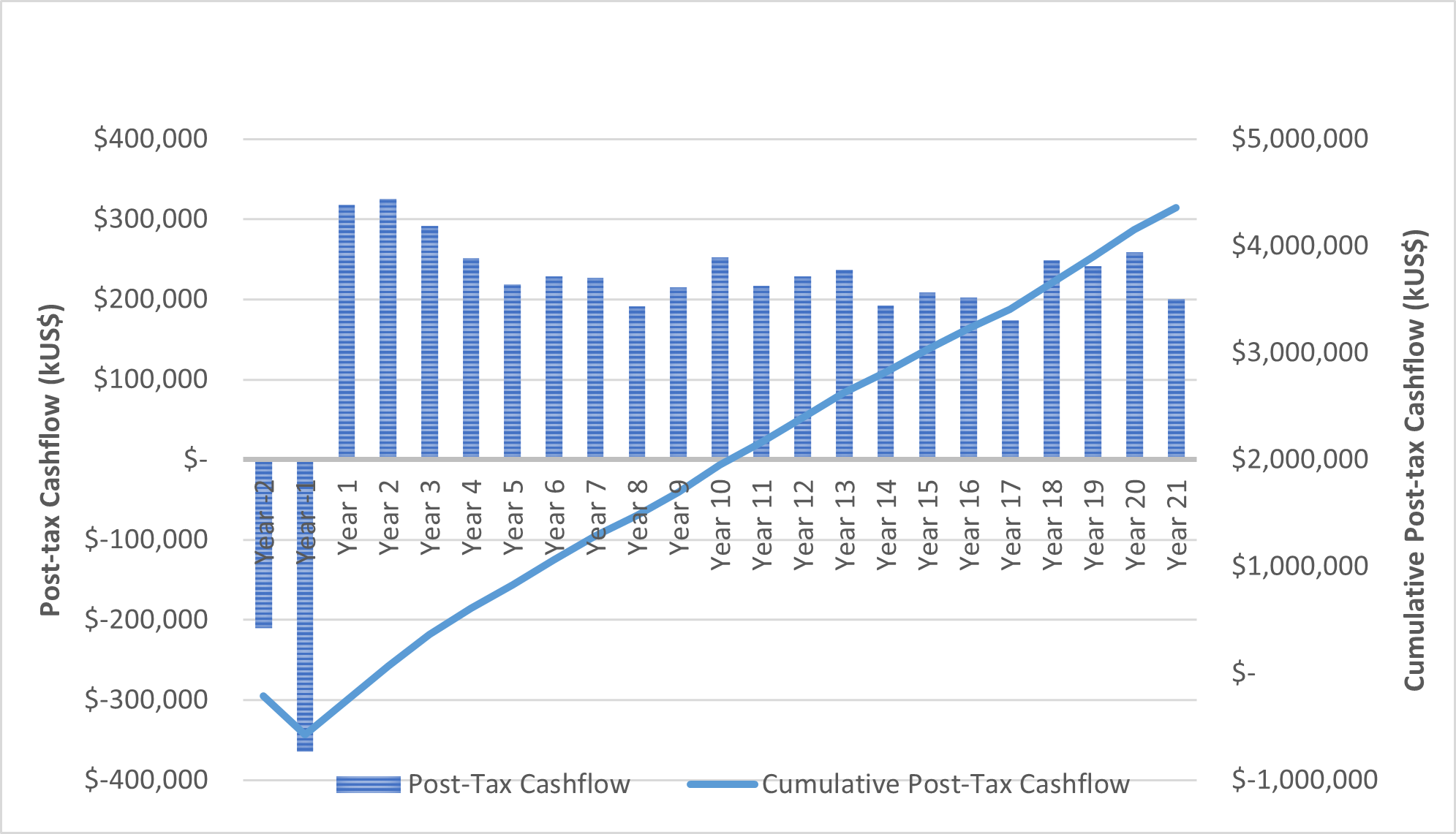

Overall Project Economics

The overall project shows potentially robust economic results for a preliminary mine plan using only Indicated Resources of the North Zone and leaves significant upside potential from the conversion of Inferred Resources in the future:

- An after tax NPV at 8% discount rate of US$1.6 Billion and IRR of 43%

- Potential 21-year mine life, with positive after-tax cash flow commencing in Year 1 of operation.

- Free cash flow post tax is estimated to be approximately US$235/annum over 21-year Life of Mine.

There is potential to enhance the value of the overall project through future upgrading of the North Zone Inferred Resource (507Mt) and the potential mining of the South Zone Indicated Resource (119Mt) and Inferred Resource (76Mt) that would be expected to improve the economics by potentially increasing the overall Life of Mine or open up the potential for future expansion in production capacity.

Estimated Post-Tax Cashflow (in US$)

Technical Disclosure

The PEA and other scientific and technical information contained above was prepared by various “qualified persons” in accordance with the Canadian regulatory requirements set out in NI 43-101. The content has been reviewed and approved by as it relates to geology, deposit, sampling, drilling, exploration, QAQC and mineral resources: Marin IUND Ordre des Géologues du Québec (OGQ No. 1525), the Association of Professional Geoscientists of Ontario (PGO, No. 3123), and the Northwest Territories and Nunavut Association of Professional Engineers and Professional Geoscientists (NAPEG licence No. L4431); Carl Pelletier Ordre des Géologues du Québec (OGQ, No. 384), the Association of Professional Geoscientists of Ontario (PGO, No. 1713), the Association of Professional Engineers and Geoscientists of British Columbia (EGBC, No. 43167), the Northwest Territories Association of Professional Engineers and Geoscientists (NAPEG, No. L4160), and the Canadian Institute of Mines (CIM) as it relates to Mineral Processing and Metallurgical Testing and Recovery Methods: Mathieu Girard Ordre des Ingénieurs du Québec (OIQ, No. 106546); and are all Independent qualified persons, as defined under NI 43-101 The technical information contained in this news release relating to the Preliminary Mining Plan has been reviewed and approved by Pierre-Jean Lafleur, P.Eng. (OIQ), who is a Non-Independent Qualified Person with respect to the Company’s Mont Sorcier Project as defined under NI 43-101. The technical Information contained in this news release as it relates to infrastructure, mining costs, project development and financial modelling has been reviewed and approved by Clinton Swemmer, P.Eng. (PEO) who is a Non-Independent Qualified Person with respect to the Company’s Mont Sorcier Project as defined under NI 43-101.

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions. There is no guarantee the project economics described herein will be achieved.

Sign up for our newsletter